The Current Financial Reality of South African Women & What They Can Do to Improve Their Money Situations

National Women’s Month 2022

“August is a special tribute to and a celebration of South African women. They are truly remarkable – they juggle various responsibilities, including managing their money situations. And, when it comes to their financial circumstances, they do indeed need the support and encouragement from their community and loved ones to continue to take care of their finances as best they can,”

confirms Carla Oberholzer – spokesperson and debt advisor.

The DebtSafe team recently released the “South African Consumers’ Financial Reality” survey results, and the following top women-related insights & highlights shed some light on the several financial challenges women regularly get confronted with:

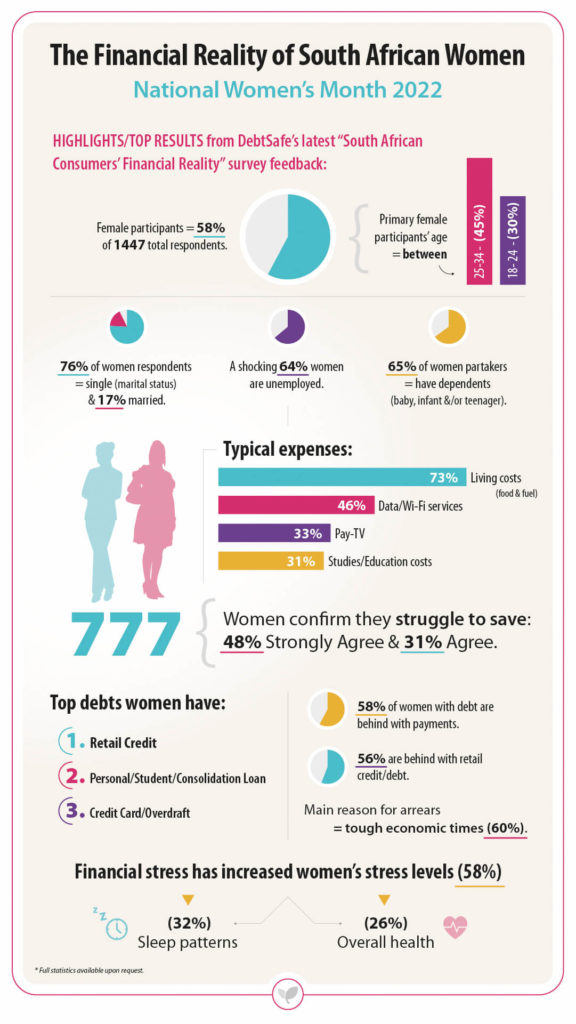

- The majority(58%) of the 1447 overall respondents (survey group) are women.

- The primary women participants’ age is between 25-34 (45%) and 18-24 (30%).

- 76%of women respondents are single, and 17% are married (main marital status indications).

- A concerning 64% of women are unemployed.

- 65% of women (survey) partakers take care of dependents (mostly babies, infants and teenagers).

- Women’s typical expenses include living costs (food & fuel) – 73%, Data/Wi-Fi services – 46%, Pay-TV (33%) and Studies/Education expenses – 31%.

- Seven hundred and seventy-seven (777) women confirm they struggle to save: 48%Strongly Agree, and 31% Agree.

- The biggest reason women can’t save is the high cost of living (food, grocery prices, and fuel expenses).

- The main debt obligations women have, are retail credit; personal/student/consolidation loan(s) and credit card(s)/overdraft(s).

- 58% of women (that have debt) are behind with payments.

- 56% are behind with retail credit/debt.

- And the main reason they are in arrears with their accounts/some of their accounts is due to the “tough economic times” they are facing.

- The current financial stress women face increases/impacts their stress levels (58%), sleep patterns (32%) and overall health (26%).

The above statistics not only portray a realistic picture of South African women’s money matters but can inspire women and their close circle to ensure they continue to take care of important financial aspects and responsibilities in the future.

Oberholzer and the DebtSafe team recommend the following five (5) practical tips for consideration:

1. Income boosts

South African women are creative, and testing the entrepreneurial grounds can do wonders, whether women currently have an income or if they want to up their income. The key is to play it smart and use what they already have available:

- If they have access to a computer, what about considering design, layout, teaching, tutoring or editing freelance options?

- When they have an extra room available on their property, why not rent it as student accommodation?

- And, what about becoming a part/full-time boot camp, spinning or fitness instructor? Ideas and considerations are endless.

2. Avoid the Joneses

Women must focus on keeping their mini-economy afloat instead of trying to keep up with family members, neighbours or celebrities (materialistically speaking). No number of shoes, branded jackets and jewellery can ever compare to feeling content and proud of their money achievements (paying for studies/education, taking care of the children and sticking to a shopping list).

3. Financial self-care & family care are equally important

For those women, mothers, grandmothers and ‘household sustainers’ – planning/taking care of their financial future and goals is crucial. If they don’t (financially) care for themselves, they will not be able to care for others. Women must ensure they get the support they need to assist with their finances. Professionals are available to guide them with budgeting and using the best financial products concerning saving, retirement planning and debt management for example.

So, when caring for dependents, women also need their households to support them/keep their hands strong. Children have to know what the budget portrays and how they can play their part to help balance the budget book. Whether it is to help mom stick to the grocery list, do chores to receive money to attend a sports tour OR help save for a well-deserved and anticipated weekend breakaway.

4. Balance the budget book

Women must set up a budget (the basic income minus expenses calculation) and cut their spending leaks (regular takeaway meals or service fees not being utilised). And, they have to ensure that their debt to income ratio/percentage stays in balance (add up all debts, divide the amount by the income amount before deductions, and multiply it by 100 to compare). Managing their budget will allow women to know more about their current situation and to do something about it (if it is less than favourable). This will also lessen stress levels as they know they are taking control of their finances.

5. Clear debt & slowly but surely start saving money

Debt can happen to anyone, so women should not be too hard on themselves. Instead, they can apply specific methods to clear their debt. For those who want to see progress in a short time, the snowball effect can be implemented to pay off the smallest debt first and then move on to clear the more expensive amounts (with usually high-interest rates like a credit card). For those women who are a bit more competitive – the avalanche method is a way to first tackle the more immense debt amounts and, afterwards, the smaller ones.

But, a more sustainable approach is necessary for women who have checked the budget more than twice, done everything possible to cut costs, and are overwhelmed by debt. Professionals can offer the support women need to take control of their debt and start saving money for an emergency fund, a birthday gift or a long-term goal like a car. So, for women who still receive a stable income each month, Debt Review is a regulated, legal and sustainable process to consider that can turn their financial woes around and help them regain financial freedom again.

Happy #WomensMonth to all the South African superwomen.

Keep doing what you do best and remember: you have support – seek it, use it and continue to manage those finances as best you can.