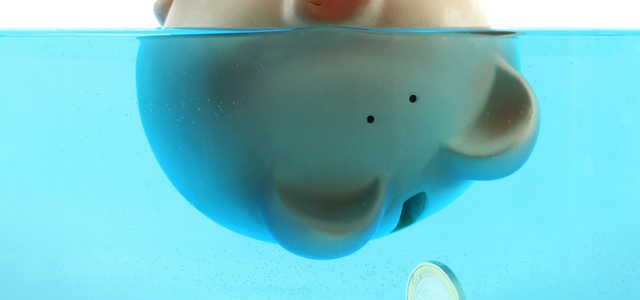

Check Your Bank Statements

Most people never or rarely look at their bank statements or credit card statements. And when they do they’ll often find strange amounts deducted for things they haven’t authorised. The easiest way to find any strange amounts going off your accounts is to plan debit orders for more or less the same time each month.