Over-Indebtedness. What It Is, & What Your Options Are

Debt is as typical in South Africa as potholes. But there’s a big difference between simply owing money (indebtedness) and being over-indebted. Why

Debt As Famous Fictional Characters

Welcome to the wild world of debt! It’s a place where every type of debt has its own vibe, just

Reframe Your Thinking Retake Control: How to Shift Your Mindset for Financial Freedom

Let’s face it: dealing with debilitating debt is overwhelming, and getting caught in a riptide of negative thoughts, feeling helpless,

Having Debt In South Africa: 8 Factors that Make it Uniquely Challenging

The weight of debt is universal, a crushing burden shared by millions across the globe. Yet, in South Africa, it

Understanding Debt Consolidation Loan vs Debt Review for Severe Over-Indebtedness

When managing debt, many individuals often confuse the concepts of a consolidation loan and consolidating debt through debt review. To

Are You Guilty of Lifestyle Inflation? Here are the 6 Warning Signs

What Is Lifestyle Inflation? Lifestyle inflation is spending more as income rises or upping your lifestyle without regard to your

Are You Recycling Your DEBT?

Credit cards offer convenience and financial flexibility when used responsibly. However, if mismanaged, they can lead to a never-ending cycle

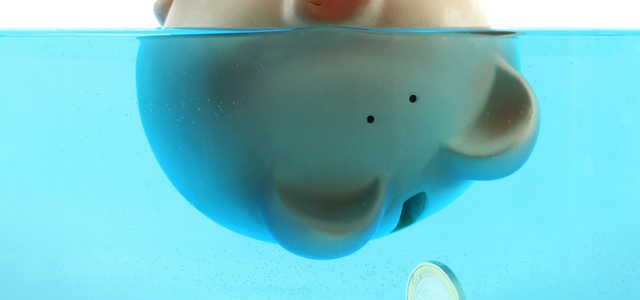

National Savings Month: South Africans Are Scraping The Bottom

South Africa has one of the lowest savings rates in the world, which has significant implications for the average citizen.

Obscure Costs: The Gremlins Eating Your Budget

We all know the sinking feeling of encountering unexpected expenses that appear out of nowhere. Often lurking in the shadows,

Winter Tips: Low Energy, High Savings

Looking for ways to save on your electricity bill in South Africa? This guide offers practical tips to help households

Unlocking the Secrets of Financial Success: What the Youth Can Teach Us!

In honour of Youth Month, we celebrate the vibrant spirit of the younger generation. While wisdom comes with age, there

From Over-Indebted to Financial Freedom: A Journey Worth Taking!

On the journey from over-indebtedness to financial freedom, the destination is well worth the challenges along the way. Not only

Prime Suspects: 9 Tactics Marketers Use to Influence Your Spending

We’ve all been there, captivated by clever marketing tactics that swayed our purchasing decision. Whether a limited-time offer or an

New Year, New Insights to a Financial-Wise 2023

The New Year is an ideal time to put your critical goals into action. What better way to start 2023

‘BAD’ Debt – The Christmas Gift That Keeps on Taking…

Christmas festivities has begun. And, given that you, your fellow South Africans, and the rest of the world continue to

Avoid Upcoming ‘Wants’ Purchases If Your Income (or Budget) Doesn’t Allow It

Exercise caution when participating in any upcoming Black November online or in-store ‘shopping bonanzas’ simply because you ‘can’ or ‘want’.

Create a Money-Conscious Mindset & Take Care of Your Overall Health

Wellness and health (including mental health) have been critical topical issues and discussion points for quite some time.

The Current Financial Reality of South African Women

The Current Financial Reality of South African Women & What They Can Do to Improve Their Money Situations National Women’s

National Savings Month

The Struggle is Real: South African Consumers’ Biggest Financial Concern Is Not Being Able to SAVE for Anything The 1400+

Consumers Under Pressure from Blackouts & Fuel Prices, BUT Exports Keep Breaking Records

Consumers are under pressure from blackouts & fuel prices, but exports keep breaking records…

#YouthMonth: “Help Create in Us a Money-Savvy Youth, South Africa”

The concept of money is a fundamental skill that any adult, parent, guardian, family member or teacher can help teach our young ones. It does not only offer a victorious situation for the youth and their future financial decision-making, but it is also a win for South Africa’s economy and prosperity.

DebtSafe’s age-by-age guide contains practical ideas and considerations to help grown-ups with this imperative task.

Manufacturing Sales Hit All-Time Record

Manufacturing sales hit all-time record

By Dr Roelof Botha, Economic Advisor to the Optimum Investment Group

Thrifty Tricks to Lower Your Energy Bill & Help You Survive Load-Shedding This Winter

There are various frugal power savings tricks that you and your household can incorporate this winter to help lower your electricity usage and make your home energy-efficient. Plus, DebtSafe also has some options for you to consider to survive load-shedding these upcoming, chillier months.

Financial Freedom: How to Overcome 7 Challenges That Are Holding You Back

DebtSafe highlights seven (7) everyday obstacles that can withhold you from achieving financial freedom, as well as suggestions on how to overcome them.

Economic Recovery Gaining Momentum

By Dr. Roelof Botha, Economic Advisor to the Optimum Investment Group Russia’s invasion of Ukraine is causing an extension of

Your Rights Concerning Credit & When Over-Indebted

This month, DebtSafe is focusing on raising consumer rights awareness. Every year Consumer Rights Day is observed and celebrated on

Relationship Upkeep 101

Be Open About DEBT & Reach Financial Goals Together “When it comes to taking care of your romantic relationship (involving

Debt Management

Debt, and the responsibility to manage it, is an unavoidable part of life. Here are five practical steps to help you manage your debt for future financial success.

Romance Fraud

Romance Fraud and online love scams are on the rise in South Africa. Protect yourself from fraudsters with these 10 questions.

Top 5 Money-Related Tips for the Festive Season

The festive season is on your doorstep, and perhaps after this ‘dumbstruck year’, it can indeed be your season to

Black November ‘Specials’: Don’t Accumulate More Debt

The 2020 year has been misleading, and it feels as if the calendar has skipped a few months. November is

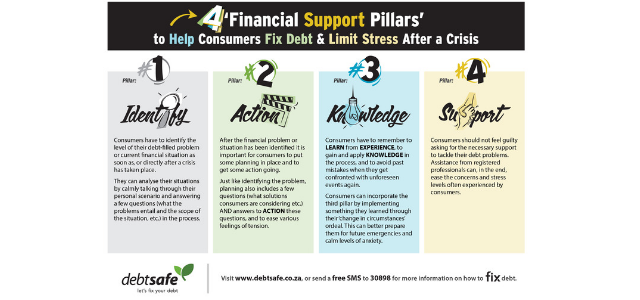

The Four (4) Recommended ‘Financial Support Pillars’ to Help Consumers Fix Debt & Limit Stress After a Crisis

South Africans’ anxiety and stress levels can be worsened by a sudden change in their financial positions or circumstances. As

Take Caution & Avoid Sly ‘Credit Cheats’ Out There

Long before the COVID-19 disruption started the government (represented via the National Credit Regulator aka NCR) and financial institutions have

Make a Money-Altering Mind Shift to Grow Your Financials

What beliefs or outdated mindset do you currently have that stops you from giving yourself (and your dear ones) a

You Received a Section 129 Notice from Your Creditor/an Attorney, Now What?

There must be no worse feeling in the world than receiving a “WARNING” that indicates you better pay up, or

Time for Debt Review: Let’s Fix Your Debt

Now is the time to consider Debt Review to fix your debt. Debt Review provides a financial lifeline when time is running out to fix your payments in arrears.

SA Women Deserve All the Love & Various Support Channels They Can Get – National Women’s Month 2020

In honour of #WomensMonth2020, DebtSafe wants to remind ALL South African women that they – the strong, the courageous –

Train Your Brain to Implement Money-Saving Tactics Even When Facing Financially Tough Times #NationalSavingsMonth

What a difficult and emotional time it has been these past few months. Not to even mention the FINANCIAL challenges

Qualified for a ‘Payment Holiday’ and NOT Able to Repay Your Dues – What Now?

You and various South Africans may be quite over the entire COVID-19 disruption round about now. Yet, you and others

Feedback from DebtSafe’s “South Africans’ Financial Reality During Lockdown” Survey Reveals Financial Concerns & Various Views

South Africans have recently shifted from a Level 4 ‘national lockdown stage’ to a level 3. And, although this level-shift

5 Characteristics the Youth Requires to Enhance Financial Resilience After an Unexpected Crisis or Emergency

It would be fair to say that recent unexpected events of the COVID-19 pandemic must have been the first severe

Repo Rate 101: What It Means for the Consumer Facing Abnormal Circumstances

COVID-19 has brought unexpected changes for the country, the economy, businesses and the South African consumer. Due to these abnormal

A Tribute to Mothers – Thanks for Making the Impossible Happen

South African mothers are experts in the field of juggling various tasks and taking care of financial commitments or bills

Consumers Under Debt Review Have an Advantage During Lockdown & the COVID-19 Crisis Period

The stronghold of debt can be devastating to any South African consumer. But, for those that have already been proactive

The Latest Repo Rate Cut – the Ideal Opportunity to Be Proactive With Your Money

With all the doom and gloom going on, you and other South African consumers (like you the homeowner, you the

Three (3) Thought-Worthy Tips: How to Manage Your Money During Lockdown

The world looks more than a bit topsy-turvy today than it did a few months ago, that’s for sure. How

Now is NOT the Time to Be a Non-Paying Consumer

The world has sure been hit hard by Covid-19, mostly known as the Coronavirus. And, panic, frustration, and uncertainty are

Coronavirus/Covid-19 Pandemic and Panic: How the Debt Review Process Fits in & Can Help You, the Consumer

Various countries, individuals, consumers and lately, perhaps, you and other South Africans have surely felt the wind being knocked out

Use What You’ve Got & Have an Affordable Easter this April

Soon the Easter weekend will be upon you. Are you ready to make it a memorable, yet affordable one this

How to Save a Few Bucks While on Holiday

Are you already cheering the upcoming school break on or perhaps, looking forward to a well-deserved getaway this coming Easter/Freedom

Consumer Rights – It IS a Big Deal, Let Your Voice Count

What’s the deal with consumer rights? Well, it is kind of a big deal when it comes to standing up

How to Protect Your Relationship from that ‘Other Partner’ (aka DEBT)

Protecting your relationship is as much important as it is difficult these days. Ever thought of debt being the culprit

Revise Your Various Agreements This 2020 & Start Saving Extra Money

Your 2020 year is here, and perhaps so far, not very unusual from all the other New Year’s that you

It’s GO TIME – Turn Your Financial Situation Around this 2020

In a flash, December has come and gone. Was all the glitz, glamour and gloss of the 2019 festive season

Ten Thrifty Tips for Eleventh-Hour Christmas Gift Shopping

Your Christmas clock is ticking. Soon you’ll hear the doorbell ring and invite familiar or long-time-no-see friends and family members

Seven Ridiculous Ways to Get Rid of Your Debt in a Jiffy

Are you a ‘debt damage dodger’ or dreamer? Perhaps one of those people with unrealistic expectations when it comes to

From Black Friday & Cyber Monday to FLAT BROKE TUESDAY

The biggest shopping phenomenon is just around the corner and, you better know what you’re in for if you are

Debt Stress – A Current Health Hazard for South African Consumers

South Africans know only too well how hectic life can be. Juggling various tasks at work, perhaps trying to hold

What Does A Debt Counsellor Do?

Due to a high unemployment rate, economic uncertainty and various unforeseen circumstances, South Africans are experiencing financial strain. Sounds familiar?

The Damage of South Africans’ “Mindless-Swiping Culture”

Due to the fast pace exploitation of consumers’ shopping experiences and need for instant gratification, it is undeniable how easy

9 Grocery Shopping Hacks for Every Woman to Consider

It is evident that groceries are really expensive these days and it is, therefore, fair to help you and other

Four ‘Financial Self-Care’ Tips for Mid 20 to 40-Something Women

It is officially National Women’s Month and, therefore, significant that South Africans celebrate the accomplishments women achieve, and the ongoing

Make Room for Unique & ‘CrazywaystoSave’ Money (National Savings Month 2019)

July is indeed the month of savings awareness and this year’s #CrazywaystoSave theme is the ideal encourager to get you

OVER-INDEBTEDNESS: Erase This Debt-Laden Meaning & Reality from Your Life

Indebtedness can refer to you or someone that owes money (to say, creditors) and it is a concept widely recognised

What We as South Africans Searched for in the Last 10 Years

We are proud to announce that DebtSafe is celebrating its 10-year birthday this 2019. The team has assisted over 30

Use a Suitable ‘Evacuation Plan’ to Fix Four Different Debt Stages

Debt is not necessarily a bad thing when it comes to your credit score, but the problem comes in when

‘Eggs-tra’ Tips That Won’t Damage Your 2019 ‘Easter-cation’ Budget

It has been such a fast-paced 2019 already and perhaps you haven’t taken time to take a deeper peep into

Incessant Increases = No Joke for Consumers’ Already Dire Pockets

With a national election creeping closer, recent and on-going geopolitical, deal/no-deal waves, ‘walls’ – call it what you will –

5 Financial Management Skills You Need to Take Care of Your Money Matters

In a world full of economic uncertainties, know this: your money does matter so make it work for you. And,

DEBT Does NOT Discriminate

Happy Human Rights Month to each and every South African. Since Human Rights Day and World Consumer Rights Day are

Tax Goes up for Consumers’ ‘SINful’ Pleasures

South Africans surely kept Honourable Minister of Finance, Tito Mboweni, under the magnifying glass on 20 February 2019. And, rightfully

DEBT – Your ♥Love-Hate Relationship

Is February your heartfelt reminder of love? Or, is it perhaps a mere indication of the absence thereof? Whatever your

Duck These Debt Duds & Start to Fix Your Financial Mess

In reality and all sensibleness, you are not able to control the economy, food prices, fuel hikes and various upsurges

Recover, Restore and Renew Your Finances This 2019

The ‘wising-it-would-just-be-here-already’ 2019 is almost on your doorstep. And, are you not excited beyond words that the New Year can

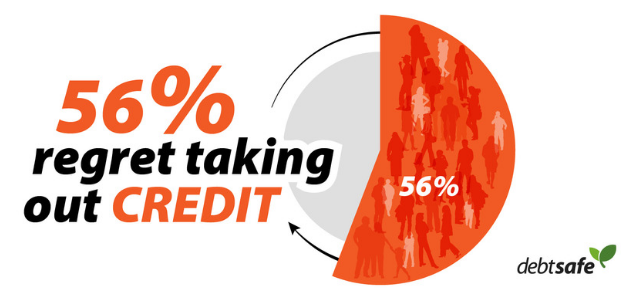

South African Consumers Regret Taking Out Credit

Whether South Africans make extra debt just to get by or whether they take out credit to upkeep various responsibilities

The Snowball Effect of ‘Just a Little Bit of Debt Here and There’

Have you perhaps noticed that Christmas is starting earlier this year – referring to all the buying that it is

SPEND Now to SAVE Later

The 31st of October is World Savings aka World Thrift Day. This year (2018) the focus of the #WorldSavingsDay2018 initiative

Change the Way You Think About Transport and Become a Frugal Traveller

Has this month’s fuel increase kicked in and your pocket is without a doubt feeling the effect of it? Not

Prepare Your Pocket and Have a Rand-Wise Christmas This 2018

In a few months’ time, Christmas will be on your doorstep. And, are you certain that you are financially prepared

Considerations to Have a Frugal, Yet Special Wedding Day

It is not only spring that is in bloom currently, but also many couples (you and your better half may

The Reality of South Africa’s Debt-Filled Culture

The proof is in the pudding. Many South Africans are forming part of a modern-day debt-filled culture. And, whether they

3 Clicks to Over-Indebtedness

It is shocking and scary to know that consumers can pave their way to over-indebtedness with just three (3) clicks

More Debt, More Drama

A bit of drama in your life cannot hurt. It only makes you stronger, does it not? Well, to be

Women’s Month 2018: How to Develop a Thrifty Money Psychology

South African women don’t only tackle their daily schedules hands-on; they are also known as providers, chauffeurs, caretakers and so

Recommended Ways to Turn Your Debt Around

Debt is such a familiar topic these days that you may feel: “Ah, same old talks, what on earth can

Madiba Wisdom: How to Make Your Way to Financial Freedom

Proper finance management is one of the most valuable things that you and every other South African can implement in

Four Important To Do’s to Keep Your Credit Score in Check

Do you have any idea what your credit record is reflecting? You might be under the impression that everything is

#FIXIT: A Mid-Year Monetary Plan to Repair Your Finances

It is almost July and somewhere along the line, you could not stick to your financial resolutions as pledged. You

Grow to Fiscal Independence with a ‘Financial Father Figure’

To all the twenty- and thirty-somethings, with it being youth month and Father’s Day that is around the corner, what

Debt Review Myths

There are many Debt Review myths that people wrongly believe. Having incorrect or incomplete information undermines your ability to choose

‘Financial Energy Boosters’ for South Africa’s SUPERMOMS

A mother is not simply just a mother or a juggler, multi-tasker and a ‘can’t-live-without-you’ type of being. Mothers are

DebtSafe Dictionary

A short dictionary of the terms you’ll come across in Debt Review, Debt Counselling and Debt Consolidation. Alternatively known as

Use These Four Financial Freedom Fighters and Tackle Your DEBT

Excessive debt is such a burden. Are you sure that you want to carry your debt load throughout your lifetime?

Reckless Credit: Two Sides of the Same Coin

Loans, clothing accounts, expensive furniture buys and credit upon credit. The South African consumer’s debt struggle is heart-wrenching and unfortunately

How the VAT Increase Is Going to Affect YOUR Financial Environment

April is here and it is in all probability your worst financial reality check. You may possibly even call it

Five Steps to Stick to Your Financial NEEDS & not WANTS

Don’t you just love the smell of fresh bread, donuts and other pastries as you pass the grocery store’s entrance?

The Right to a Debt-Free Future

This month is an important reminder of South Africans’ human rights, and rightfully so. But, if there is one thing

Find an Exit Door to Certain Service Agreements

#DebtExit On the news side of things – many citizens anxiously awaited a new open door for South Africa. With

Don’t Let DEBT Hurt Your Relationship

It is the month of love – red roses, chocolate hearts and dinners by candlelight. BUT, are you sure that

SEXUALLY TRANSMITTED DEBT

The perfect story – boy meets girl, you fall in love and move in together… In some cases your ‘partnership’

If You Have Debt, Get Yourself Covered

Having various debt obligations these days, is nothing new. This includes debts like a credit card, a bond or a

Seven Significant Steps to a Debt-Free 2018

The year is coming to a swift end and it is almost time to start afresh with your 2018 financial

How to ‘Jingle’ Your Christmas Day Budget

Matthys Potgieter, spokesperson and debt expert at DebtSafe, says there are still five things that you can take into account

Bonus or Tax Refund Anyone?

Are you one of the lucky South African consumers expecting to receive a 13th cheque or tax refund soon? It

Don’t Let DEBT Ruin Your Health

There is no doubt about it – times are tough and most citizens are barely (or not even close to)

Five Tips for an Enjoyable, Thrifty Christmas

September is an eventful month as spring is in full swing. Are you already listing the ways you can make

Five Financial Habits of a Debt-Free Consumer

Get rid of your out of season financial habits by trying out these five practices regularly implemented by debt-free consumers:

The Reckless Lending and Borrowing Cycle: Time to Face Reality

Many South African consumers are unaware of the true state of their debt, and sooner or later the dire consequences

Cash is King: How to Improve Personal Cash Flow

Current economic times are tough and uncertain. Citizens face regular fuel and food price hikes/drops, negative fiscal predictions, political agendas

Additional Income Boosts for Consumers to Consider

After paying tax, covering rent, and paying those unavoidable bills, numerous consumers feel financially miserable. For some, it seems like

10 to Do’s When Groceries Leave Your Wallet High and Dry

Have the August grocery winds caught up with you lately – leaving your finances disheveled and wondering where in the

5 Tips to Stay Young, Happy and Financially Free

Are you a young, twenty-something individual, relatively fresh out of high school, college or university kick-starting your career? This new

Freeze Your Spending

Who said winter is cold and tedious? It is never too late (or chilly) to apply new financial habits to

SMART Financial Goals

Who said you can only set goals every New Year? Not to mention financial goals. No, goals should be a

Time to Re-GROW Your Savings

As many consumers may have noticed, July is National Savings Month. It is, therefore, the best time to start afresh

Bad Financial Habits Can Lead to Debt Disasters

A personal financial disaster can happen when you least expect it. Although you may feel that the bank, creditors and

The Swearword for Consumers

RECESSION First South Africans received the shocking blow of being downgraded to junk status, then the fuel price increase was

Charity Starts at Home

Ever considered being part of something bigger than yourself? Now is your chance. A day to take action and doing

Create a Savings Culture

July is National Savings Month and there is no better time for us South Africans to get proactive with our

Stop Leaving Your Finances out in the Cold

Face it, spending a few minutes doing fiscal planning, budgeting and continually improving your finances, cannot be seen as a

Voluntary Surrender vs. Repossession

Anyone’s financial situation can change overnight. It is nothing out of the ordinary for unforeseen crises (like retrenchment, divorce, life-threatening

A Swipe Here, a Swipe There, Confusion Everywhere

Don’t fool yourself; a personal credit card equals DEBT. When you use a credit card, it feels so easy and

Ready, Steady…Wait, Are You Ready to Buy a House?

Having your own garden, garage, braai area and a place to call home gives you peace of mind, doesn’t it?

Start Becoming a Green Family

Modern and desperate times call for modern and desperate measures. As it is the twenty-first century, people should make lifestyle

Get “Eggcited” and Save This Coming Easter

Easter weekend is upon South Africans. For some, it is a deep and spiritual time, and for others, a time

Financial Stress Can Impact Your Mind, Body and Overall Wellbeing

There is no doubt about it – times are tough, especially after the devastating news about South Africa’s sovereign credit

JUNK STATUS – What Now?

Many saw it coming and some even tried to ignore it, but unfortunately, South Africa’s biggest fear has come true

10 Money Tips to Keep Your Special Day Within Budget

Weddings are ridiculously expensive. And can cost between R100 000 and R200 000 nowadays. Couples get overly excited when they find the

Busting 6 Debt Counselling Myths

Debt counselling offers an ideal solution – an effective debt repayment plan for many over-indebted South Africans. A debt counsellor’s

Know Your Consumer Rights

An important part of South Africa’s economic growth is consumers’ trust in their preferred product or service providers. They have

Budget Speech 2017: A few potential effects on over-indebted consumers

Our Minister of Finance’s budget speech is not only going to be under the magnifying glass by rating agencies this

Debt, Your Silent Relationship Killer

It is that time of year – red roses, chocolate hearts, and dinners by candlelight. Ah, the month of February

Ways to Build a Healthy Emergency Fund

Life is always throwing curve balls and from time to time you will have to deal with unexpected additional bills.

What Will Your Workouts Really Cost You?

Now that 2017 is in full swing a lot of people are still working hard on making a success of

GROW Financial Stability This 2017

It is the ideal time to clear your mind and to start thinking about clever ways to do a few

Have Yourself a Money-Light December Break

The big December summer break is here, and plans are being made for holidays, family get-togethers, gifts, and fun activities.

How to Make the Most of Christmas on a Shoestring Budget

Christmas day is almost here and while many families are going to financial extremes for this special time of year,

5 Tips For The Tough Economic Times

South Africa’s economic news is understandably making everyone nervous. From recent fraud charges that were laid and withdrawn against our

Car Repossession: What are your rights?

Car repossession has a major impact on your life. Everything becomes more difficult – getting to work, getting the kids

4 Reasons People Do Not Save Money

When was the last time you could look back at the past month and think “wow, I really saved a

What “Junk Status” Means To You and Me

South Africans are panicking and holding their breaths while international markets decide our country’s fate. We have recently been thrown

More Money in Your Pocket after the Budget Speech

After a few weeks of exciting talks and reviewing Finance Minister Pravin Gordhan’s Budget Speech, people are starting to have

The 2016 Budget Speech and How It Affects You

South Africans are facing radical increases in especially daily living costs and housing in a time of increasing unemployment and

DebtSafe Welcomes Changes to Retirement Funds

National Treasury this week announced changes to tax treatments of retirement fund contributions in provident, pension and retirement annuity funds,

Understanding What Debt Review Can Do For You

When do you know it’s time to investigate whether debt review is something you should consider? Let’s take a look…

Spend Less in December: 4 Tips to Avoid Overspending

The holiday season is just around the corner and people are holding their breaths… 2015 has been a year filled

Check Your Bank Statements

Most people never or rarely look at their bank statements or credit card statements. And when they do they’ll often

Helpful Tips to Pay off Student Loans Faster

For the past few weeks’ South African universities were under siege by students protesting increasing tertiary fees and student debt

New Affordability Assessment Regulations

In an effort to stop reckless credit granting, the National Credit Amendment Act (NCAA) has proposed affordability assessment requirements. Consumers

Spending Habits and Credit Cards

People’s cash-flow is getting stretched more and more each month. But if you’re finding yourself relying heavily on your credit

Unemployment and Debt

Stats SA announced that the unemployment rate in South Africa has declined by 1.4% to 25% between the first and

Repo Rate Hike a Wake-Up Call for South Africans

When the South African Reserve Bank (SARB) governor Lesetja Kganyago last week announced a repo rate hike of 25 basis

Why Debt Review Is Your Best Option

Are you aware of the various options you have when it comes to getting out of debt? There are four

Saving for a Perfect December Holiday

The “silly season” is almost upon us and although this period is supposed to be joyous, many people stress about

2015 National Savings Month

South Africa is celebrating National Savings Month this July. But this is also the time of year a lot of

World Bank Stats 2014: South Africans Are Biggest Borrowers

In an article published on a well-known online publication this week, statistics from a survey done by the World Bank

Raising Money Savvy Kids

As a parent, you recognise that money will play a fundamental role in your kids’ life. Having proper personal financial

SA Students Get Low Marks on Budgeting

A recent survey by Student Village revealed that South Africa’s students may be driving themselves into debt while at university.

Winter Wealth: Tips to Warm up and Save up on Your Electricity Bill

Keeping warm during the icy months from April till July can become expensive. We’ve grown accustomed to relying on appliances

Making Your Inheritance Work for You

Receiving a portion or all of your inheritance, whether as a reward or due to the passing of a family

Online Spending: What You Need to Know

A little under a decade ago, acquiring cash or purchasing goods or services was a lot more difficult than it

South Africans Unaware of the State of Their Credit Profiles

The recent amendments in the National Credit Act (NCA) will make it more difficult for consumers to turn to unsecured

The Latest Amendments to the National Credit Act

The latest amendments to the National Credit Act, gazetted on Friday 13 March, carry far-reaching implications for both consumers and

The Cost of Getting a Divorce

The rate of divorce continues to increase in South Africa, as seen by the massive increase of 28% in divorces

The Free DebtSafe Budget Template

46% of people who completed our survey stated that they do not have a financial plan or budget for 2015.

Safeguarding Your Stokvel

Stokvels – which date as far back as the 1800’s – are by no means a new concept in the

Janu-Worry 2015 Survival Guide: 6 Steps

It seems that all indications of an epic 2014 summer vacation has come to an abrupt end. With 2014 now